The Post Oak Hotel at Uptown Houston Receives Coveted Forbes Travel Guide Five-Star Rating

September 3, 2020

Hospitality | Press Release

October 11, 2021

Christopher Helman, Forbes

October 11, 2021

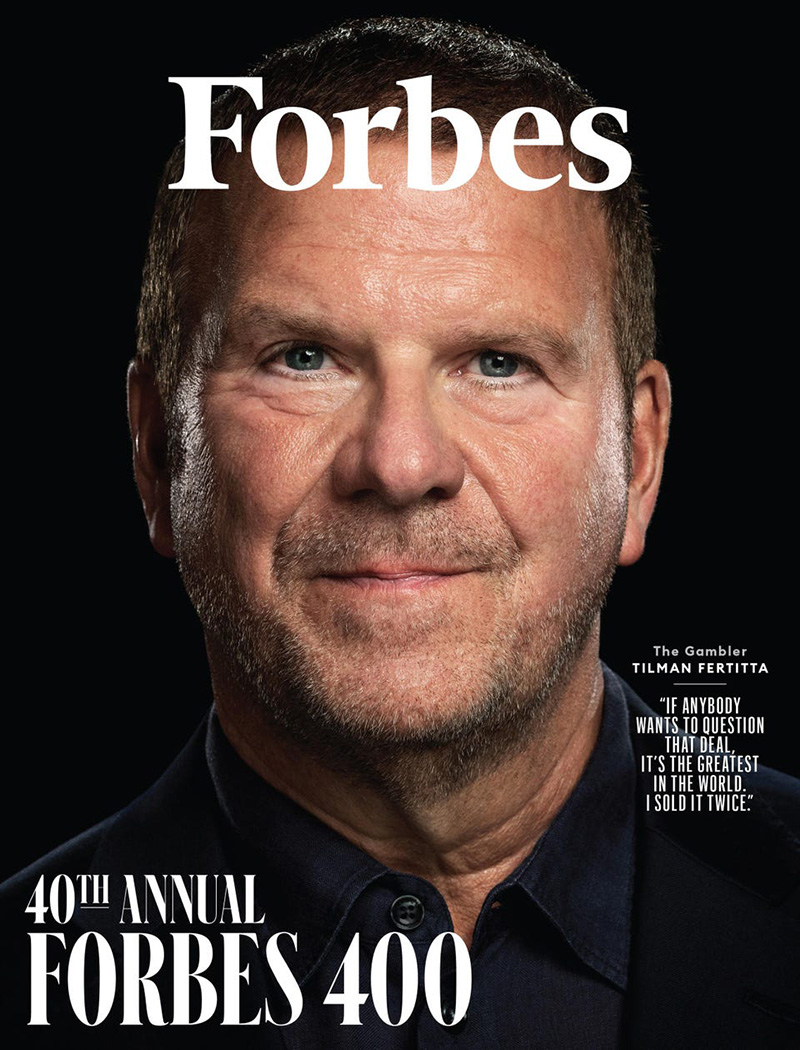

When Covid lockdowns hit, Tilman Fertitta’s restaurants and casinos took a serious hit, and he had to lay off 40,000 workers. But now, the Golden Nugget casino owner is richer than ever thanks to seismic market shifts and his own ambitious SPAC strategy.

“We are expecting you—may I take your shoes?” says the uniformed crew member stationed at the bottom of the stairs leading up to the main deck of Tilman Fertitta’s new 252-foot yacht, Boardwalk. The shoe policy is understandable. Fertitta lavished $150 million and nearly five years on this vessel, spending days with Dutch shipbuilder Feadship imposing his obsessive vision for six decks of plush carpets, marble surfaces, chromed fixtures and automatic sliding doors. There are cabins to sleep 22 crew and 14 guests, who often arrive via a de rigueur helipad. Fertitta’s favorite spot is the top deck, 74 feet above the sea and overlooking the hot tub. His fifth yacht, Boardwalk dwarfs the other ships docked at the Atlantis resort at Paradise Island, Bahamas. He still owns No. 4, a 164-footer anchored in his hometown of Galveston, Texas. Asked if he ever rents out his yachts to defray costs, he summarily dismisses the question. “If you need to charter, you shouldn’t own it.”

You can describe the 64-year-old yacht, restaurant, casino and hotel owner in many ways: as a showman, risk taker, college dropout, detail guy, NBA owner (the Houston Rockets), reality show star (three seasons of Billion Dollar Buyer on CNBC) and the fellow who bought Donald Trump’s casino in Atlantic City out of bankruptcy in 2011 and made a success of it. But the one identity that has arguably made the biggest impact on his wealth is that of a sharp financial engineer with a history of cutting the public into and out of his ventures and taking on and offloading debt at opportune moments.

“We always get bigger and stronger during tough times,” Fertitta says. In the 2001 downturn, he gobbled up troubled restaurant chains at a discount. In 2010, in the wake of the Great Recession, he took Landry’s Inc. private, buying the 45% he didn’t own for $1.4 billion in cash after it had spent 17 years as a public company.

This time around, Fertitta could have ended up going broke under $4.6 billion in debt accumulated to build his empire. Instead, he’s getting richer by making use of the era’s hottest financial trend: the special purpose acquisition company, or SPAC. Thanks to creative SPAC financing and what appears to be some serious self-dealing, Fertitta has already increased his net worth, Forbes estimates, from $4.1 billion a year ago to $6.3 billion today. In December, Fertitta hopes to close on his fifth SPAC deal, the biggest transaction of his career, in which he will offload most of Landry’s holdings, including five Golden Nugget casinos and more than 500 restaurants (and billions in debt), to the rechristened Fertitta Entertainment. If all goes as planned, he’ll end up with a 74% stake, worth some $4 billion, in the new public company and a personal net worth topping $8 billion. (Landry’s restaurant brands include Bubba Gump, McCormick & Schmick’s, the Palm and Rainforest Cafe.)

SPACs, of course, are publicly traded shell companies that raise money to facilitate a future merger with an unnamed private company that might not have the heft or the patience to do a traditional initial public offering, with all the federal scrutiny that entails. SPACs have boomed the last two years thanks in no small part to all the cheap money the Federal Reserve has pumped into the economy. From just 59 deals raising $14 billion in 2019, SPAC offerings surged to 248 raising $83 billion in 2020 and 443 raising $127 billion in the first nine months of 2021, according to SPAC Analytics.

Others have done more SPAC deals than Fertitta. Billionaire venture capitalist (and bitcoin enthusiast) Chamath Palihapitiya has launched six SPACs, using them to take public the likes of Opendoor, Virgin Galactic and Clover Health. And others have gotten richer (at least momentarily). United Wholesale Mortgage CEO Mat Ishbia is now worth around $8 billion (down from almost $13 billion since January) after his family-owned company went public through a merger with a SPAC sponsored by billionaire investor Alec Gores, who has done eight such deals.

There’s a lot to question about the SPAC boom, including seemingly guaranteed profits for sponsors and hedge funds. If Gores and Palihapitiya are the most active, Fertitta may be the most aggressive, resorting to brazen maneuvering of which few large investment firms would approve.

In one notable case, he stood on both sides of a crucial deal for Golden Nugget Online Gaming. In 2019, before the pandemic, Fertitta and his longtime bankers, Jefferies Financial Group, raised $250 million for a SPAC (Landcadia Holdings II) with the stated aim of acquiring an entertainment company. Fertitta got a 10% promoter’s stake, plus the titles of co-chairman and CEO.

In March 2020, when Covid-19 lockdowns began, Fertitta shuttered nearly all his operations and laid off 40,000 workers. He received $160 million in forgivable federal paycheck protection program loans—but gave it all back to Uncle Sam after public outrage over big operators getting cash intended to help small businesses.

“If anybody wants to question that deal, it’s the greatest in the world. I already sold it once. Now I’m selling it again.”

Instead, that April, he drew an emergency $300 million loan at a rate of nearly 13% against his Golden Nugget Online Gaming division (GNOG), which had become a pandemic bright spot, with people stuck at home gambling their federal stimulus money. The loan was liquidity insurance, he says: “I didn’t spend any of it.”

Two months later, in June 2020, Landcadia II announced it had found its acquisition target—none other than Fertitta’s own online gaming division, the one with that pricey loan. When his SPAC closed on the purchase of GNOG in December 2020 for $745 million (six times revenues), Fertitta ended up with 49% of GNOG’s shares and a $30 million cash payment. He was also rid of the obligation to pay back that emergency debt—and able to keep the borrowed $300 million.

“These sorts of maneuvers ensure that sponsors win regardless of the performance of the merged company,” scolded four Democratic U.S. Senators, including Massachusetts’ Elizabeth Warren, in letters they wrote to Fertitta and five other SPAC kings in September 2021, asking them to account for seeming conflicts of interest and urging the SEC to take a closer look. Michael Ohlrogge, a law and corporate governance professor at New York University, says there have been only about a dozen cases in the last few years in which SPAC sponsors bought affiliated companies, and for good reason: “Whenever the buyer and the seller are the same party, you have to wonder if the price is going to be fair.”

Not that GNOG investors are complaining. This past August, Fertitta reached a deal to sell GNOG to DraftKings (itself born of a SPAC) for $1.5 billion in stock. “If anybody wants to question that deal, it’s the greatest in the world,” he crows. “I already sold it once. Now I’m selling it again.”

“Whatever you do, don’t say I got my start peeling shrimp,’’ Fertitta implores during a marathon eight-hour-plus interview that includes dinner at Nassau’s famed Graycliff restaurant, where the bill for four runs to $1,500. It ends after 2 a.m. with Fertitta, his 27-year-old son, Patrick, and a Forbes reporter lounging on a platform that folds out from the hull of Boardwalk, watching spotted manta rays swimming below.

Special purpose acquisition companies now account for more than half of all cash raised in U.S. initial public offerings. In 2016, when Tilman Fertitta launched his first SPAC, Landcadia Holdings I, such deals made up just 14% of the IPO market. It was a flop. His second, Landcadia Holdings II, is faring far better, despite criticism that he used it to buy his own online gambling division.

But Fertitta’s restaurant and entertainment roots are as much a part of his colorful backstory as his financial acrobatics. His grandfather Vic Fertitta and great-uncles Salvatore and Rosario Maceo ran the Balinese Room in Galveston, a nightclub that featured entertainers like Frank Sinatra and Bob Hope. (The Maceos, immigrants from Italy, allegedly ran gambling and bootlegging in Galveston.) His father, also named Vic, owned the Galveston seafood joint Pier 23—where, yes, young Tilman shucked shrimp and by age 14 was managing the restaurant, learning the business hands-on.

He tried not to be in restaurants. In the late 1970s, after dropping out of the University of Houston, Fertitta launched a women’s clothing shop, stores that sold vitamins, an arcade game distributor and a construction company. In 1985, at 28, he opened the 160-room Key Largo Hotel in Galveston. He showed up at his high school reunion in a limo (“I owned it”). Soon he sold the Key Largo for $600,000 to his cousin Frank Fertitta (who, with brother Lorenzo, later became billionaires from casinos and mixed martial-arts promoter UFC, which they sold in 2016).

Tilman used that cash to help him buy Houston eateries Landry’s Seafood Inn & Oyster Bar and Willie G’s from the Landry brothers and expanded to Galveston, Corpus Christi and San Antonio. He got overleveraged with $10 million in debt, but “outlasted the banks” after the 1987 downturn and paid off his loans for $2 million. In the late 1980s, he started buying up restaurants on the marina boardwalk in Kemah, on Galveston Bay. In time he erected a Ferris wheel and turned 40 waterfront acres into his first “eatertainment” district, with Joe’s Crab Shack, Saltgrass Steak House and more.

By 1993 Fertitta was generating $2.7 million in profits on $34 million in revenue, and raised $24 million in Landry’s first IPO. To save pennies he cut the size of french-fry orders and put out fewer lemon wedges. “Among Tilman’s superpowers are that he understands the numbers behind the numbers, what they pay for beef and beverage,” says Richard Handler, CEO of Jefferies Financial Group.

In 2000, Fertitta offered $125 million for the jungle-themed Rainforest Cafe chain. Rebuffed, he snapped it up later that year for just $75 million when the economy hit a rough patch. In a 2010 book, Rainforest founder Steve Schussler described Fertitta as a “brash, arrogant, bargain-basement, bottom-feeding acquisition nemesis.” Schussler was miffed when Fertitta decided to save $100,000 per location per year by getting rid of live bird displays. Reached at his restaurant laboratory in Golden Valley, Minnesota, Schussler recants his previous description, saying he now believes a Fertitta-style numbers obsession might have enabled Rainforest to survive independently. “If it meant the Audubon Society came in and bought margaritas, he’d have twice as many birds,’’ he says of Fertitta. (The two have since collaborated to create the T-Rex Cafe near Orlando, Florida, which features animatronic dinosaurs.)

In 2005, Fertitta bought the two Golden Nugget casinos, in Las Vegas and Laughlin, Nevada, for $295 million. He swapped out old restaurants for his hottest chains, then added three more casinos in Biloxi, Mississippi, Lake Charles, Louisiana, and Atlantic City, where he picked up the rundown Trump Marina casino resort for $38 million.

Billionaire Steve Wynn, who made his first fortune expanding the original Vegas Golden Nugget casino in the 1970s, says that while he had always tried to “steal the top end” (i.e., the highest-rolling Asian baccarat players), his friend “Tilly” makes sure he has something to appeal to gamblers at every level. To Fertitta, it’s all about numbers. “What’s more valuable to a casino, one $1 million player or ten $100,000 players?” asks Gerry Del Prete, who runs Golden Nugget’s gaming operations. The answer, he explains, is the 10 relative minnows, because you can make as much money off them, with less volatility, while providing fewer expensive perks.

Still, Fertitta does like doing business with other rich folks. His Post Oak Hotel and Spa in Houston, opened in 2018, features a Rolls-Royce, Bentley and Bugatti dealership, which he owns, in the lobby. Celebrities and athletes pay $600 and up per night to see and be seen at its pools and Mastro’s Steakhouse. His son Patrick pulls up on his phone the new song “N 2 Deep” by Drake, which features lyrics about a woman he calls “a little Post Oak baby.” In September Drake tweeted a clip of himself shooting hoops at the Post Oak’s penthouse court.

Fertitta says he has spent $400 million on the hotel and adjacent office building. In August he invited Forbes to his headquarters to argue for boosting our estimate of his net worth. For his biggest trophy, Fertitta in 2017 finally bought the NBA’s Rockets (he first acquired a 3% stake in 1983) for a then-record $2.2 billion, raising funds by borrowing against Landry’s.

With Landry’s leveraged to the hilt, the pandemic hit. “For four weeks you were just scared to death,” Fertitta recalls. “You can’t save the world, so you’ve got to make tough decisions”—like laying off 40,000 workers. (He says he has since refilled all but 3,000 positions.) “I caught so much shit for it because I was the first one who did it,” he says. Not that he second-guesses himself. “You’ve got to remember, it’s all my money. At other companies CEOs are not so quick, because it’s not theirs.”

With his operations all but shut down, Fertitta was surprised to see a bright spot emerge in his eight-year-old Golden Nugget Online Gaming division. With revenue of $1.7 billion in the first half of 2021, America’s online gambling industry has already surpassed its record 2020, boosting the value of Fertitta’s stake in GNOG to $600 million. But Fertitta will be just as happy to let DraftKings run that business day-to-day. DraftKings generated $600 million in revenue in the first six months of the year but spent so much building market share that it posted a $650 million net loss. “It’s against everything that I do. Everything, to me, has to make money,” Fertitta says. “Let them run the company, let them fund the losses.”

There have been only about a dozen cases the last few years where SPAC sponsors bought affiliated companies—and for good reason: “Whenever the buyer and the seller ARE the same party, you have to wonder if the price is going to be fair.”

It gets better. Before the pandemic, Fertitta had been working on a preliminary prospectus to take Landry’s public. Instead, a deal came to him via Fast Acquisition, a SPAC launched in 2020 by marketing guru Doug Jacob (who sold his agency Jwalk to Shiseido Americas in 2017) and Sandy Beall, founder of the Ruby Tuesday chain. They agreed to sweeten the pot for Fertitta and reduce their promoter’s shares by 40%, Jacob says, in order “to do a once-in-a-lifetime deal with one of the best operators of all time.” In February they announced a $6.6 billion deal to merge most of Fertitta’s restaurants, the five casinos and his stake in GNOG/DraftKings into Fast, creating a new public company to be called Fertitta Entertainment. In June, Fertitta announced that he would expand the deal, adding assets like the Kemah boardwalk district, Galveston Pleasure Pier, Denver Aquarium and more restaurants. This boosted the headline number to $8.6 billion. Piling in more assets also helps soften the balance-sheet impact of the billions in debt he’ll push over to the new company, reducing leverage from 5.2 times Ebitda to a still hefty 4.3. He’ll have a 74% equity stake and the CEO job.

Fertitta will hold on to select restaurants, hotels including the Post Oak and, of course, the Rockets (Forbes values the team at $2.5 billion). But the new public company will be his growth platform; he wants a property on the Las Vegas Strip.

What could go wrong? Well, resurgent Covid-19 could hit travel and restaurants. A stock market slump could sour investors. And his overall leverage still runs high, especially for a hodgepodge of restaurants and casinos. Moreover, shares in the average SPAC have lost money after a year, and some are ending up in litigation. That’s the fate of Waitr, the Louisiana-based food delivery service that Fertitta and Jefferies acquired in 2018 via their first SPAC, Landcadia I, which raised $250 million. Waitr shares have lost 90% of their value, and class-action plaintiffs accuse him of making false statements pertaining to Waitr’s “huge potential” in taking on the likes of DoorDash and Grubhub, and their “highly complementary” nature with his other businesses. His attorneys have filed a motion to dismiss the case as lacking any actual claims of fraud and say the talk was merely “corporate optimism and puffery.” A decision on the motion is pending.

But for now, life is good. Fertitta intends to spend 30 nights a year on Boardwalk. This summer he had his ex-wife, Paige, and their four kids there for a week. Their 2017 split was amicable. He has been married for two years to Lauren Ware, formerly a litigation counsel for Landry’s.

Fertitta acknowledges it’s a complicated time to be so flashy. “The world has changed. People hate billionaires,’’ he laments, especially those who have become so much richer during the pandemic. “Go look at social media—I never posted one thing about the new boat. As public as I am, I’m also very private,” he says. You’ll never see selfies from his yacht on Instagram. “And remember, it was [Forbes] who asked me” for a tour of Boardwalk. Yes, and thank you for the hospitality. Fertitta has already started imagining his next yacht, perhaps a 361-footer by German shipbuilder Lürssen.